Wednesday, July 22, 2009

Auto Insurance Policy Limits - My Two Cents (Part 3)

Tuesday, July 21, 2009

Auto Insurance Policy Limits - My Two Cents (Part 2)

Auto Insurance Policy Limits - My Two Cents (Part 1)

In Washington -- and I dare say in most if not all states -- auto insurance is required. This is going to be a 3-part blog entry. This first part will discuss the basic types of typical auto insurance coverages. Of course, I can't discuss all the details; so feel free to call or contact us if you have specific questions. But I will try to cover the basics. In Part 2, I'll talk about some suggestions for insurance if you're a low wage earner; and in Part 3, I'll make suggestions for those whose income and assets are moving in the right direction (i.e., up!).

The coverage that the State cares about is referred to as "Liability" coverage. This is the insurance that will hire you an attorney and pay a settlement or judgment to someone you have hurt or damaged. Bottom line: you're in an accident that's your fault; the other driver is injured; they sue you. Your insurer hires an attorney for you, and eventually pays the other driver to settle the case - or if the case goes to trial, pays the judgment. Washington requires that drivers carry a minimum of $25,000 in liability coverage (often referred to as BI coverage). That means that if you have the minimum, your insurer will pay up to $25k to resolve your case. If your accident has caused someone to incur more damage than $25k, you can be 'stuck' for anything above the $25k. Your insurer won't pay more than the limits you've purchased. You can, of course, purchase more than the $25k limits. You can purchase limits into the hundreds of thousands -- and as I'll discuss in Part 3 of topic, into the millions!!

Wednesday, July 15, 2009

If You're Hurt - Get Checked Out!

- I didn't have money to pay for it

- I didn't have insurance to pay for it

- I hate doctors

- I hate pills

- I didn't have the time

- I thought it would get better on its own

- My (fill in the blank) told me it wasn't necessary

Understand this: one or more of these may really be true. You may really be hurt. But the bottom line is -- it doesn't matter. If you are in an accident, and you don't seek treatment for many weeks (or worse, many months or more), you are in trouble. I don't mean medically. Because when it comes to your medical care, that's between you and your health care provider. I mean 'legally,' or better said -- 'claim-wise.'

The 'other guy's' insurance company is going to look at your claim and give it short shrift. They're going to assume that: the pain wasn't bad enough to get you to see a doctor; or some other event caused the problem; or more likely, it will reasonably (and probably - correctly) assume that a jury won't buy it. And even your own insurance company -- the one you may be looking for to pay some of your medical expenses under your PIP coverage -- will be extremely concerned. It will probably send you for an IME (an examination by a doctor of its choosing) and hope to get a report back saying that your have no objective problems that are related to the accident. Then it will use that report to deny your PIP claim.

All-in-all, it's a real mess. Defense attorneys know it. Plaintiff attorneys know it. Insurance companies know it. Juries (eventually) know it. The excuses don't fly!!

I can't tell you how many times I've observed the importance of this very basic rule: both in a negative way and a positive way. The negative way is simple. As a defense attorney, I've used this scenario on numerous occasions. Juries and arbitrators don't like seeing months of non-treatment; and the claimant ultimately pays with a low claim result. As a plaintiff's attorney, I've had to counsel my clients about this problem. I've occasionally refused to represent a client under these circumstances - either recognizing that the delay is unexplainable, or because the client doesn't believe me.

But I've also seen situations in which early treatment has proved incredibly helpful to a claim. I had a client, recently, who was in an accident and felt a little sore but didn't want to see a doctor. She relied on excuse # 6 (I thought it would get better on its own.). Fortunately, a friend of hers was a client of mine. About 2 weeks after the accident, the friend encouraged her to call me. I told her to go see her doctor. She insisted that she felt she'd get better -- even though she hadn't improved over that 2 week period. I asked her - tongue in cheek - where she received her medical degree. She went to her doctor.

The doctor noted a typical radiculopathy pattern -- pain, tingling, numbness -- and sent her for an MRI. Two days later she was sent to a neurosurgeon who diagnosed an extruded disc in her neck; and a day after that she was in the hospital undergoing a very significant surgery. Had she waited months before going through this process, the legal outcome might have been very different. Perhaps she would have been in another accident, or a fall. The longer she would have waited, the more difficult it would have been to prove that her spinal injury was related to the accident. But fortunately, having obtained an MRI just 2 weeks after the accident, the 'proof was in the pudding.' Proving her injury was related to the accident was no longer a problem. Her surgery was successful; and once she recovered, we were able to resolve her claim for a significant 6-figure settlement.

If you are in an accident, don't use the typical excuses to avoid medical treatment. If you have symptoms, get them evaluated. It's always better to have a doctor's visit where the result is insignificant, than to avoid the doctor when the result would have been significant -- medically and legally.

Rick

http://www.magnusonlowell.com/

Tuesday, July 14, 2009

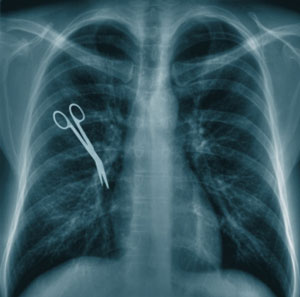

Even Doctors Make Mistakes Occasionally

I'm not a proponent of rampant medical malpractice claims. I think attorneys get a bad rap for being 'sue happy' when it comes to suing doctors. The fact is, most attorneys I know who handle medmal cases are far from sue happy. In fact, they tend to be just the opposite. Frankly, there's a lot of self-interest in attorneys minimizing bringing medical malpractice lawsuits. This is because:

I'm not a proponent of rampant medical malpractice claims. I think attorneys get a bad rap for being 'sue happy' when it comes to suing doctors. The fact is, most attorneys I know who handle medmal cases are far from sue happy. In fact, they tend to be just the opposite. Frankly, there's a lot of self-interest in attorneys minimizing bringing medical malpractice lawsuits. This is because:- a) they are very expensive to bring;

- b) they are extremely time-consuming for the attorney and office staff;

- c) the doctor's insurance companies have huge financial resources to fight the claims; &

- d) the doctors, themselves, can reject a reasonable settlement -- even if the doctor's attorney and insurer believe settlement is appropriate.

And since almost all such cases are handled by the injured person's attorney on a contingency fee basis (i.e., the attorney only gets paid based on a % of any settlement or recovery), it is in the attorney's best interest not to take a 'loser' case. I'm a big believer in taking good cases; and leaving the 'dreck' behind.

But sometimes, there are good cases. And unfortunately, a doctor's pride can sometimes get in the way of a reasonable, responsible, and timely resolution. Such was the case in a situation in which my client came to me complaining of a goof by her hand surgeon. I won't get into the specific medical details. Suffice it to say that she went into her doctor for a surgical procedure to correct a condition in which one of the bones in her hand had been damaged. As you might know, the hand has many bones. They all work together to give us the ability to manipulate items with great dexterity. In this case, the doctor was supposed to remove the small damaged bone and replace it with a filler. Unfortunately, the doctor messed up. He removed the wrong bone -- the healthy bone immediately adjacent to the damaged bone.

For months, my client was in pain. The surgery didn't seem to have worked. She complained to her surgeon, who merely accused her of being a whiner and chastised her for refusing to actively participate in her prescribed post-surgery physical therapy. She finally sought a second opinion from another surgeon who, without difficulty, discovered the operating surgeon's error.

As an attorney, this was one of the easier medical malpractice cases to prove. After all, we had x-rays from just before the surgery, and x-rays from shortly after the surgery. We had the surgical report from the errant surgeon, and the surgical report from the subsequent surgeon who had to try to fix the unfixable goof. (It was almost as straightforward as a case in which a surgeon amputates the wrong limb!) Yet, when faced with this clear cut evidence, the initial surgeon refused to admit his error. So we were forced to commence a lawsuit.

The lawsuit didn't last too long. The handwriting was on the wall. The doctor attempted to come up with explanations for the problem; but none made sense. Finally, during his deposition, I asked him what could explain the fact that the damaged bone was present both before and after his surgery; but that a previously healthy bone was missing following his surgery. And although he admitted these facts; he admitted no explanation for how that could have occurred. The only thing he was sure of was that he didn't do it. It sounded like a 9-year old boy trying to explain who broke the vase; while standing among the broken glass with a hammer in his hand.

Fortunately -- finally -- his attorney and insurer were able to convince the doctor to authorize a settlement (undoubtedly explaining to him that he would look pretty foolish on the record in front of a jury).

Doctor's make mistakes. So do lawyers. So do plumbers, electricians, builders, teachers, drivers, policemen ... you name it. Let's face it. EVERYONE makes mistakes. It doesn't make them bad people. In fact, it makes them human! When people make mistakes, it's always better to just admit them and move on. When people make legal mistakes, the answer is really the same (although, perhaps, after consultation with an attorney).

With the overwhelming evidence against this doctor, he should have admitted the mistake, and allowed his insurance company to handle it on his behalf. It's unfortunate that he put up a silly -- non-existent -- fight. As a practical matter, it cost him more. He needed to spend substantial time away from his practice dealing with the litigation process -- and frankly, my client might have been willing to settle for less had the doctor not forced her to sue in the first place.

There's a lot to be learned from basic kindergarten rules --- like admit your mistakes and move on.

Rickhttp://www.magnusonlowell.com/

Wednesday, July 8, 2009

When in Doubt - The Truth is Always the Right Answer

Over 20 years ago, I was handling a case in Everett, Washing-ton; defending a young law school student who had the misfortune of rear-ending a woman on a wet street on a rainy day. The client was embarassed by his inability to stop; but felt solace when he got out of the car and noticed that the only damage to the woman's car was a slightly bent rear license plate holder. No one was hurt. They exchanged the standard information and went on their way. My client was astonished when, a few years later, he was sued.

I started looking into the woman's claims. She had a myriad of complaints - her neck, her back, headaches, etc. And further, she claimed that she had suffered brain damage from the accident; and that her psychiatrist had recommended in-patient cognitive treatment. She had run up over $15,000 in chiropractic bills (a huge sum 20 years ago), and needed $25,000 for the cognitive treatment. She also claimed that she had been unable to work since the accident. This was a huge claim and she wanted compensation.

The woman had further claimed that prior to the accident, she had never had any neck problems, back problems or headaches that required medical intervention or treatment. She had told this to me; and to her psychiatrist. But as I was reviewing her medical records, I came across a reference to a prescription for Tylenol 3, written about 6 months before her accident; a drug typically given by doctors for significant pain complaints. The prescription was written by a doctor who the woman had not properly identified. I quickly obtained those records; only to find reference to neck pain, back aches, and headaches. And also a referral to a mental health clinic. I rushed to obtain those records, too. The woman had not disclosed the clinic, either.

So fast forward to trial. Her psychiatrist is on the stand. He's testifying about her condition and her need for cognitive treatment. He made an impressive witness on her behalf; but then it was my turn to cross-examine the doctor. I asked him whether she had suffered from pre-accident neck pain, back aches or headaches. He said "no." I asked him if she had any pre-accident mental health conditions or complaints of depression or memory problems. Again, he said "no." And the doctor testified that his opinion -- that her current problems were related to our accident -- was based on the fact that his patient did not have any pre-accident problems of that nature. I then pulled out the records I had recently obtained and began asking whether he was aware of the various pre-accident symptoms. In each case he said "no." And then I asked him whether the existence of those symptoms during the 6-8 months prior to the accident might serve to change his mind. The doctor said: "They might. I'd need to look at the records."

Well, I looked at the clock. It was 5 minutes to noon. I said to the Judge: "That sounds fair, Judge. Perhaps we can break for lunch now, and the doctor can review these records over the lunch break?" The judge agreed. I handed a copy of the records to the doctor, and he left for lunch. Shortly before court reconvened, I ran into the psychiatrist in the hallway, and he handed me back the stack of records, commenting "Wow, I had no idea!" That's all I needed to hear. Back on the stand, I asked the doctor whether, following his review of the records, he had a change of opinion. Not surprisingly, the woman's psychiatrist recanted all of his prior testimony; indicating that everything she complained about to him following our accident was something she had complained of during the few months before the accident. With that, her case unraveled quickly.

After closing arguments, the jury went into the jury room to deliberate. I packed up my bags, jumped in my car, and drove over to my wife's grandmother's home. She only lived 10 minutes from the court. As I walked in the door, the phone rang. It was the court clerk, advising me that the jury was ready to return a verdict and I had to return immediately.

I'm sure you can guess the result. Despite a clear-liability rear-end accident, the jury returned a verdict against my client in the amount of $0! Once it was apparent that the woman had lied to her doctor and to me (and probably to her own attorney, too), the jury was unwilling to believe anything she said. She got nothing!!

So what's the moral of the story? It's pretty basic, isn't it? Tell the truth. Tell the truth to your doctors; tell the truth to your attorney; tell the truth to the other attorney. Just tell the truth; period. It's often said: you'll never have trouble remembering the truth; it's lies in which you can get mixed up. Stick to the truth. Maybe you won't hit the 'home run' you were hoping for in court; but more likely, you'll get the fair compensation you deserve. Lie, and you'll get nothing (or worse).

Rick